Therefore anything below the daily time frame should be ignored. Besides using the Bullish Engulfing Pattern as an entry trigger, it can also alert you to potential trend reversal trading opportunities for an engulfing trading strategy. Next, you need a valid entry trigger to get you into the trade such as the bullish engulfing candle. The first step in applying the engulfing candle day-trading strategy is to determine the dominant trend direction, and thus the direction you will trade-in.

APAC morning brief: Japanese yen rise as First Republic Bank woes … – ig.com

APAC morning brief: Japanese yen rise as First Republic Bank woes ….

Posted: Tue, 25 Apr 2023 07:00:00 GMT [source]

Mr.Rayner, your Forex lessons cum videos are just incredulous. It’s really improving my understanding of the dynamics of forex trading. I normally use the Bullish engulfing in an uptrend, (similar to MAEE formula), combined with an oversold stochastic for extra confirmation.

How to trade with engulfing candle indicator?

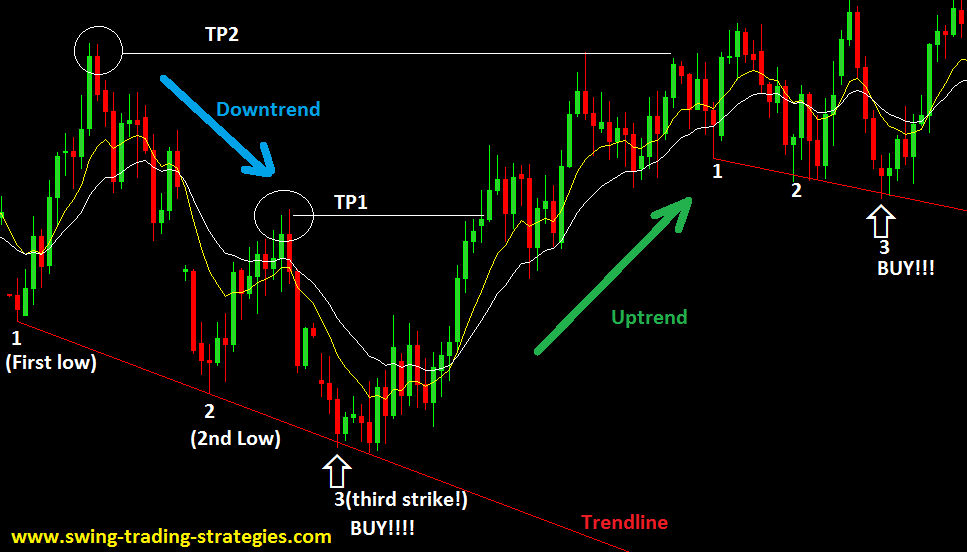

This pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow candle. Support and resistance levels are important in trading because they help you identify entry and exit points for profitable trades. Put, support is a level where the price tends to stop falling, while bullish engulfing pattern resistance is a level where the price tends to stop rising. To use a stop-loss order effectively, you need to first identify the support and resistance levels of the market. These are points on the chart where the price has historically tended to either stop falling (support) or stop rising (resistance).

- During a downtrend, you should take only short positions, selling a borrowed asset with the intention of buying and returning it later at a lower price.

- Therefore, hold the trade for at least a 45-cent gain to compensate yourself for the risk you’ve taken.

- As you can see, the USD/CHF pair was in a downward trend when a smaller red (bearish) candle was followed by a bigger bullish candle.

- To help avoid this, consider allowing multiple candles to create an engulfing pattern.

- Prices move in waves, advancing, pulling back, and then advancing again.

The period of the moving average should be chosen according to the one that the price is respecting. If you want to take advantage of this powerful setup you need to wait for the right locations along with the current market structure. Completely deleting all the work that the sellers had to build that previous bearish candle. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. The pattern is also a sign for those in a long position to consider closing their trade.

How to identify candlestick patterns in charts

It’s important to wait for the second candlestick to close before entering a trade. In this pattern, the most recent candlestick fully engulfs the body, high and low of the previous candlestick. The most recent candlestick will have red color while the previous candlestick will have a green color.

Which pattern is best for bullish?

The bullish engulfing pattern and the ascending triangle pattern are considered among the most favorable candlestick patterns. As with other forms of technical analysis, it is important to look for bullish confirmation and understand that there are no guaranteed results.

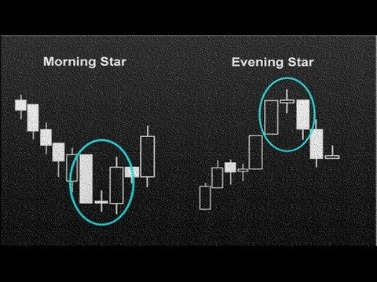

With the trend isolated and a pullback occurring, wait for the engulfing candle strategy trade signal. It is worth noting that many patterns, such as abandoned babies and the harami pattern, come in both bullish and bearish forms, depending on which direction the market is moving in. A bullish harami can indicate that a period characterised by downward price movements may be coming to an end.

Live Trading with DTTW™ on YouTube

Note that the engulfing candle’s range completely engulfs the previous candle. If the Bullish Engulfing Pattern is at least 1.5 times ATR, then it’s likely to be a strong price rejection. Once the pattern has formed and confirmed, you may enter a long position. It will draw real-time zones that show you where the price is likely to test in the future.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. For a perfect engulfing candle, no part of the first candle can exceed the wick (also known as the shadow) of the second candle. This means that the high and low of the second candle covers the entirety of the first one. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money.

Step #1 Spot a Sideways Market

As subsequent candles close above the high of the bullish candle, this validates the signal, indicating a trend reversal to the upside. First, you should learn how to identify a bullish engulfing candle. In the crypto market, the second candle doesn’t necessarily open at a price lower than the “close” position of the red (first) candle. The higher open price of the green candle is quite a usual thing. As the green candle closes at the level above the previous (red) candle, we can state that the engulfing pattern takes place.

They watch them appear in the charts and trade them everywhere. Don’t forget to follow us for more informative content on forex and stock trading strategies. Stay on top of upcoming market-moving events with our customisable economic calendar. Discover the range of markets and learn how they work – with IG Academy’s online course. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution.

What is the 3 candle rule?

The pattern requires three candles to form in a specific sequence, showing that the current trend has lost momentum and a move in the other direction might be starting.